Rising sea levels are submerging coastal areas, floods are breaching barriers, and communities are battered by more intense and frequent cyclones. These catastrophic impacts disproportionately affect the poorest and most vulnerable people in Least Developed Countries (LDCs) and Small Island Developing States (SIDS), who lack the resources to respond effectively. Despite their minimal contribution to global emissions, these countries face a severe funding gap for adaptation, and loss and damage. Even if developed countries meet the $300 billion climate finance commitment made at the last COP, over 80% of the funding needs for adaptation and loss and damage will still have to be met by the affected countries themselves. This highlights the urgency of innovative and inclusive financing mechanisms to support the most vulnerable.

A complex issue – needing agile funding

Climate impacts vary widely by context, with countries that have weaker infrastructure, lower socioeconomic resilience, and constrained fiscal capacities often bearing the brunt of even low-intensity climate stresses. Vulnerabilities are further exacerbated for marginalized groups—such as women, children, Indigenous peoples, and persons with disabilities—who face systemic barriers, including limited awareness, restricted access to resources, and exclusion from decision-making processes. Addressing these risks effectively requires finance with the following characteristics:

- providing diverse, context-specific solutions grounded in everyday realities and tailored to the vulnerabilities of different people and places.

- anticipatory, agile as well as responsive to immediate, medium to long term needs for tackling these impacts.

- moving from simple absorption and bouncing back to bouncing forward with the view to taking communities beyond vulnerability thresholds – creating transformative resilience.

- multi-stakeholder, multi- sectoral and multi-level responses.

Existing support and financing structure- not fit for purpose

Despite the growing urgency, current financing mechanisms are neither efficient nor sufficient. The current financing mechanisms remain slow, rigid, and insufficient. For example:

- Green Climate Fund (GCF) financing has complex accreditation and proposal submission processes, delaying much-needed funding.

- Humanitarian aid remains reactive and event-driven, offering little scope for proactive adaptation planning.

- Sectoral silos create artificial boundaries, separating mitigation, adaptation, loss and damage (L&D), and disaster risk reduction (DRR), which prevents holistic solutions.

The focus of funding mechanisms is often on the priorities of funds, rather than the needs of communities. Without systemic reform, funding will remain fragmented, addressing only parts of the problem rather than the full spectrum of risks communities face.

National and Aggregate Country Platforms

Under ALL ACT, two country platform models – National Platforms and Aggregate Platforms (such as the SIDS Debt Sustainability Support Service – DSSS) are being tested to overcome financial bottlenecks and ensure resources reach those who need them most. These platforms integrate diverse funding sources, streamline finance, and foster multi-stakeholder collaboration, offering a scalable pathway for locally led solutions that drive transformational change.

I. National platform: Locally led and context-specific

National platforms are designed to optimize existing resources, expertise, and delivery mechanisms to create locally appropriate, community-led solutions. They are built on six key pillars, ensuring that responses are comprehensive, inclusive, and driven by those on the frontlines of climate impacts:

- Co-creating bottom-up comprehensive risk management strategies: National platforms bring together problem holders (local communities and institutions) and solution innovators (NGOs, community-based organizations, universities, and private-sector actors) to collaboratively develop climate risk management plans. These plans are agile, cost-effective, diverse, and tailored to local needs. By leveraging tools like the C-CIQ toolkit, the approach ensures that solutions are context-specific, addressing mitigation, adaptation, and resilience-building in a holistic manner.

- Leveraging existing funding sources: By convening diverse funding streams—including public and private finance, overseas development assistance (ODA), philanthropic funds, and national budgets—national platforms break down silos to deliver coordinated and complementary solutions. This approach maximises the impact of available resources, ensuring that funding aligns with locally developed plans and priorities.

- Blending, matchmaking, and delivering agile and innovative finance: These platforms work towards pooling resources from multiple funding sources, reducing transaction costs while enhancing transparency and accountability. The governance model connects the right funds to the right projects, encourages experimentation, and scales up successful practices, ensuring that resources are efficiently deployed to benefit vulnerable communities.

- Timely and targeted delivery of funds: Partner countries are equipped with self-diagnostic tools to assess their policy, planning, budgeting, and delivery mechanisms. This allows them to identify gaps and prioritize action. For example, an assessment across eight countries revealed that an investment of $237 million in areas such as early warning systems, integrating climate vulnerabilities into social registries, disaster risk finance instruments, and collaborative delivery networks could unlock $62 billion in existing social protection investments to deliver climate resilience.

- Creating capacity and support networks: A marketplace approach connects local expertise, experience, and peer-to-peer learning opportunities, accelerating contextually relevant capacity building. This is achieved through partnerships with accountable support organizations, private sector actors, NGOs, and community-based organizations. The ALL ACT Observatory has been developed to document and share best practices, strengthening the knowledge base for locally led climate action.

- Movement building led by coalitions of implementers and actors: National platforms drive collective impact by bringing together stakeholders around a shared vision. By feeding evidence and data into global advocacy efforts, these platforms amplify the voices of LDCs and SIDS, enabling them to mobilize financial resources and shape global climate policies. Once funding flows are established, a global mechanism will track and ensure transparency in the use of adaptation and loss and damage finance.

II. Aggregate Country Platforms: SIDS Debt Sustainability Support Service

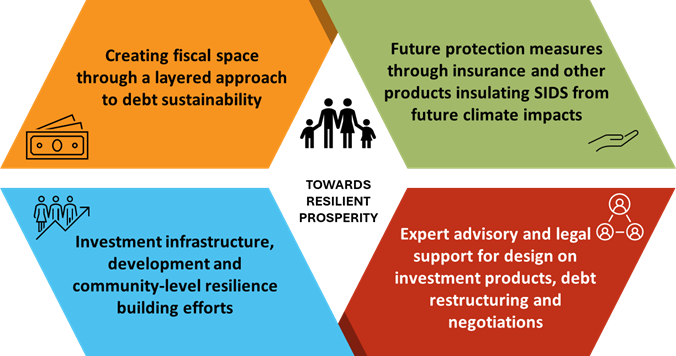

The SIDS Debt Sustainability Support Service (DSSS) exemplifies an aggregate country platform model that tackles interconnected challenges of climate change, debt, and resilience investment. SIDS face unique vulnerabilities, such as disproportionate climate impacts and escalating debt levels, which constrain their ability to invest in resilience and development. The DSSS addresses these challenges through four interconnected elements:

- A layered approach to debt sustainability: This involves multi-layered debt sustainability strategies that combine contingent clauses, parametric insurance, debt restructuring and debt swaps. The approach has been tested through simulation models to assess its impact on debt servicing and overall debt stock with the view to creating fiscal space for resilience investment. It builds on existing efforts to improve debt management and data availability in SIDS, as well as efforts to change the way debt sustainability analysis is structured and applied.

- Future protection measures: Ensuring future protection for SIDS is important so that they do not fall into the cycle of debt distress again. By instituting robust safeguards, such as insurance products that limit economic losses from climate-related disasters, countries can gain a shield against climate uncertainty. These safeguards would include designing insurance products and alternative funding mechanisms that offer fiscal breathing space and guard against future crises or shocks, including those from climate-related events that cause economic losses.

- Resilience investment: Investments in infrastructure, development and community-level resilience-building efforts can fortify SIDS against future challenges, ensuring they not only survive but thrive in the face of global challenges. These involve identifying opportunities for issuing resilience, sustainable and thematic bonds including blue or green bonds aimed at funding climate resilience initiatives while also exploring new solidarity-based resilience finance mechanisms. This is being combined with existing measures to support SIDS’ access to climate finance and build on the impact of the MVI in offering SIDS improved terms.

- Advisory and legal support: This component aims to offer specialised legal and commercial negotiation support to SIDS. Designing resilience investment bonds/ deals requires specialised legal guidance to attract private sector investment and support debt management. This assistance will empower SIDS to make informed decisions and engage in dialogues while protecting their interests and promoting their aspirations. It will also focus on building long-term legal and commercial capabilities within SIDS and regional hubs, equipping them with the skills and knowledge needed to navigate legal and commercial issues.

Designed by the Strategic Advisory Group (SAG), co-chaired by H.E. Prime Minister Gaston Browne of Antigua and Barbuda and H.E. President Dr Mohamed Muizzu of the Maldives, the operational phase of the DSSS was launched in September 2024 and is proposed to operate in the Caribbean, Pacific and Atlantic, Indian Ocean and South China Sea (AIS) regions to ensure coordinated regional responses.

Why country platforms matter

The road to scaling up country platform approaches is not without challenges. Entrenched financing structures, rigid donor priorities, and institutional barriers continue to limit the reach of locally led solutions. However, these models are already demonstrating their potential to streamline finance, enhance coordination, and empower frontline communities to shape their own resilience strategies. Even at a small scale, they are making a difference ensuring that existing finance is more accessible, agile, and responsive to those who need it most.

Policymakers and financial institutions must recognise this potential and invest in scaling up these platforms, ensuring that local actors are not just beneficiaries but leaders in designing and delivering climate finance solutions. Strengthening and expanding these approaches could be the key to bridging the climate finance gap and building resilience from the ground up, one community at a time.

Authors

With more than 20 years of senior policy development, research and management experience in government, funding agencies and international NGOs, Ritu has worked extensively on social protection, climate resilience (policy, planning and finance), forest and watershed management, resource conservation (water and energy efficiency, renewables and circular economy), livelihood and gender issues. Read more about Ritu and follow her @ https://www.linkedin.com/in/ritu-bharadwaj-410130156/

Tumasie Blair is a Senior Policy Advisor based in New York. With extensive global networks and academic qualifications in international law and public administration, as Antigua and Barbuda’s Deputy Permanent Representative to the United Nations, Blair has led negotiations on critical issues such as sustainable development and international law, and continues to advocate for small island states on climate change. Read more about Blair and follow him @ https://www.linkedin.com/in/tumasie-blair-a19159194/